powerball winnings calculator|More : Pilipinas Calculate your lottery winnings after tax using this online tool. Compare lump sum and annuity payout options for Megamillions, Powerball, Lotto and other lotteries in different . webProvas e Gabaritos. Aprenda com as experiências passadas! Consulte a lista das últimas provas e os respectivos gabaritos. 2024. 2023. 2022. 2020. 2019. 2018. 2017. 2016. .

0 · us powerball estimation sheet

1 · powerball winning numbers 2023 calculator

2 · powerball tax calculator by state

3 · powerball payout calculator by state

4 · powerball calculator puerto rico

5 · how to calculate powerball numbers

6 · calculate probability of winning powerball

7 · calculate next winning powerball numbers

8 · More

26 de out. de 2021 · Um sargento da PM teria criado um robô que garante vagas no Programa Estadual de Integração na Segurança, o Proeis, o que gerou uma denúncia de fraude cibernética. A PM do RJ abriu uma .

powerball winnings calculator*******Use this tool to compute how much tax you have to pay and compare the net payout of the lump sum or annuity option after winning the Powerball jackpot. Enter the jackpot . Here’s how much taxes you will owe if you win the current Powerball jackpot. You can find out tax payments for both annuity and cash lump sum options. To use the . Calculate your net winnings after taxes for Powerball jackpot options. See .Calculate your lottery winnings after tax using this online tool. Compare lump sum and annuity payout options for Megamillions, Powerball, Lotto and other lotteries in different .So if you really want to be a Powerball winner, then this is the cheapest & easiest way to achieve your goal. Calculate Powerball taxes in your state to see how much the lottery .powerball winnings calculator MoreLottery Calculators. Want to know how much a winning lottery ticket is actually worth? Well, these lotto calculators should give you a decent idea of what to expect: Powerball Taxes. Mega Millions Taxes. How to Win .

Learn how much tax you might have to pay on your Powerball winnings depending on the prize amount, the jurisdiction, and the payout option. Use the tax calculator to estimate . You can calculate your Powerball tax payout in two easy steps when you use the Lottery n Go Powerball calculator. Here is a step-by-step guide to calculating US Powerball payout and taxes: Fill in your .Calculate how much tax you have to pay and compare the lump sum and annuity options for Powerball jackpot. Enter the jackpot amount, select your state and see the payout chart and tax breakdown.

Legal Stuff: All calculated figures are based on a sole prize winner and factor in an initial 24% federal tax withholding. A portion of this information has been provided by usamega.com, and all figures are subject to .

More In this case, that excess amount is $49,624. To break it down, you would owe $16,290 in taxes on the first $95,376 of your income and 24% of the remaining $49,624. Consequently, out of your $100,000 lottery winnings, your total federal tax liability would be $28,199.76.Current Jackpot Analysis. The table to the right shows the advertised jackpot for the next drawing. It also works as a tax calculator, so that you can see how much is withheld, whether you want to take the annuity or the cash lump sum. The rate of federal tax varies from 24 percent to 37 percent depending on individual circumstances but will be .

powerball winnings calculator You can win $4 just for matching the Powerball, while the jackpot is won by matching all five main numbers plus the Powerball. The top prize starts at $20 million and increases every time it is not won. If there are multiple winners of the jackpot, it will be shared equally between them. The eight prizes below the jackpot are fixed amounts, so .Powerball Tax Calculator. Where was the lottery ticket purchased? . *** Winners living in New York City (3.876% extra) and Yonkers (1.477% extra) may be subject to additional taxes. Legal Stuff: All calculated figures are based on a sole prize winner and factor in an initial 24% federal tax withholding. Wyoming federal tax and state tax on lottery winnings. Federal Tax: 25 %. State Tax: 0 %. Lottery winnings tax calculator estimates the taxes on lottery winnings on the amount of the winnings, state of purchase, and lump sum or annuity payment type.

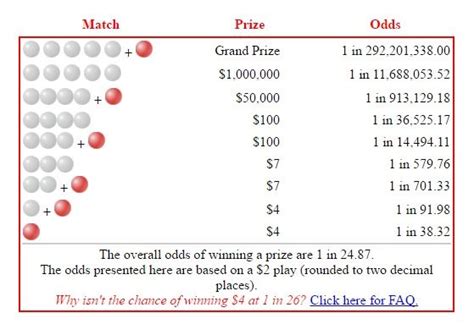

The estimated cash jackpot when the advertised jackpot is $20,000,000. $9,619,048. Withholding (24%) Federal tax. Select your tax filing status. -$2,308,571. Arizona (4.8%) State tax. The estimated amount of state tax you will pay on a cash jackpot win of $9,619,048. The highest federal tax bracket of 37% is assumed for these examples because all Powerball jackpot winners will fall into this . In the situation when the winner resides in a different state than the one where the winnings were registered, additional state taxes may be added. This calculator is intended to provide an estimate .The Powerball jackpot grows until it is won. Players win a prize by matching one of the 9 ways to win. The jackpot is won by matching all five white balls in any order and the red Powerball. Jackpot winners may choose to receive their prize as an annuity, paid in 30 graduated payments over 29 years, or a lump-sum payment.But becoming a Mega Millions or Powerball jackpot winner doesn’t change everything. If you are the lucky winner, you still have to worry about bills and taxes. This is when a lottery tax calculator comes handy. Jump to the Lottery Tax Calculator. At a glance: Lottery winnings are considered taxable income for both federal and state taxes.

Our Powerball payout and tax calculator considers a federal tax of 24% that applies to US residents. However, if you are a foreigner playing in the United States or using online lottery sites to play from abroad, a .

Updated on May 16, 2024 Fact-checked by Kanisha Kinger. Paying taxes is part and parcel of our lives. We pay taxes on our income, properties, and purchases. Similarly, when it comes to lottery winnings, taxes . The Powerball annuity jackpot is awarded according to an annually-increasing rate schedule, which increases the amount of the annuity payment every year. The table below shows the payout schedule for a jackpot of $56,000,000 for a ticket purchased in Minnesota, including taxes withheld. Please note, the amounts shown are .Betting Calculator. Before making any bet, it helps to know what you're risking for the expected payout. Enter Your 'Bet Amount' - that's what you're risking, along with the American, fractional or decimal odds. See what your total payout and winnings will be. Betting Calculator Parlay Calculator.

The Powerball annuity jackpot is awarded according to an annually-increasing rate schedule, which increases the amount of the annuity payment every year. The table below shows the payout schedule for a jackpot of $113,000,000 for a ticket purchased in Illinois, including taxes withheld. Please note, the amounts shown are very close .

If you have a different tax filing status, check out our full list of tax brackets. $0 to $11,600. 10% of taxable income. $11,601 to $47,150. $1,160 plus 12% of the amount over $11,600. $47,151 to .In this specific case, that excess amount equates to $49,624. To put it simply, you would owe $16,290 in taxes on the initial $95,376 of your income and 24% of the remaining $49,624. Consequently, from your $100,000 lottery winnings, your total federal tax obligation would amount to $28,199.76.For Michigan this is an additional 4.25%. - $25,925. Net Payout. $437,675. Note: The ‘Net Payout’ is how much you would receive from the lottery win. You would then need to include this amount on your personal income tax return and pay further income tax. The tax bracket would vary depending on your other income.

Letra da música Caia Fogo de Fernandinho - Eu não posso ficar de pé diante da Tua .

powerball winnings calculator|More